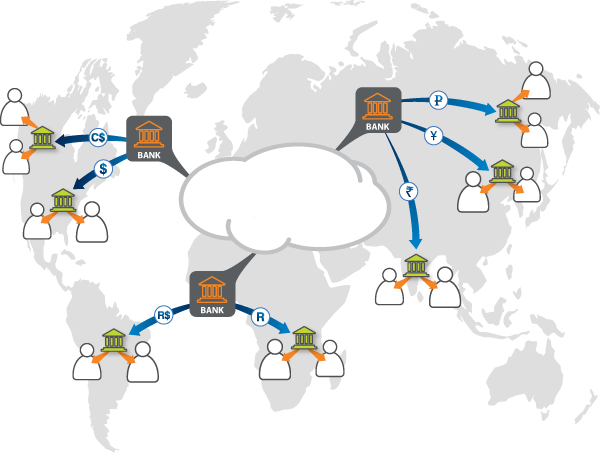

Manage international investments

For venture capital or private equity funds, managing investments and divestments in foreign currencies requires hassle-free processes and access to advanced risk hedging solutions.

Send reliable wire transfers in any currency

When making transfers or foreign exchange transactions, unreliability can cause delays in payment or reconciliation. Bensam Edfield lets you regain control, with instant multicurrency payments, competitive rates and transparent pricing, all secured with the click of a button.

Reduce your FX

risk exposure

Investments made in foreign currencies leave you exposed to FX market volatility between deal stages. Bensam Edfield offers currency hedging solutions with varying durations and degrees of flexibility, reducing currency risk in accordance with the specific nature of each transaction. After closing, you can hedge the underlying asset for the lifespan of the investment, mitigating risks and enhancing realisable value.

Aggregate all your accounts in one place

PISP accreditation means you benefit from an overview of your Bensam Edfield multicurrency accounts, as well as those held at other banks, thereby simplifying accounting consolidation. A singular overview also makes it easier to review all accounts relating to the investment vehicle you manage.

Gain competitive, transparent rates

Many international payments generate excessive fees and foreign exchange commissions, negatively impacting your profit margins. Bensam Edfield lets you regain control of your international transactions, with instant multicurrency payments, competitive rates and transparent pricing, all secured with the click of a button.

globalOne, a trusted partner for your international financial transactions

Funds segregation

In compliance with EU regulations, client funds are held in separate accounts, at leading European banks. Only clients can access their funds.